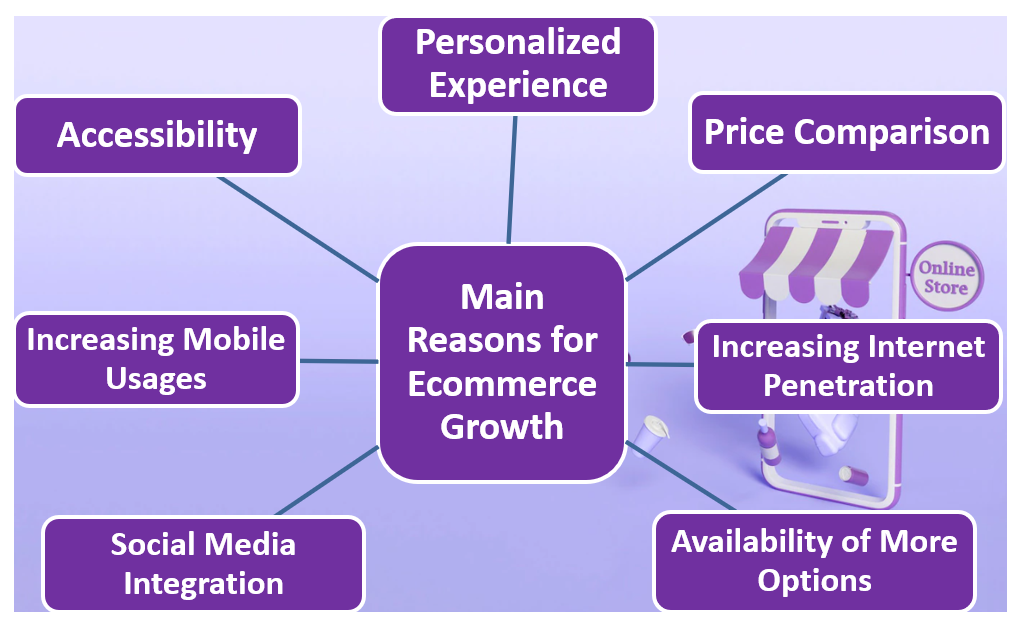

We use the jargon "In this digital era" because the world population stands at 7.9 billion, in which 5.9 billion people use mobile phones and 4.9 billion people have internet access. Furthermore, 4.62 billion people use social media, and you know the average daily time spent on the internet by each netizen in 6H: 58M, almost half the time of a person if we minus sleep time from a day. The development of the internet is still the most significant achievement of the century that changed everything into a digital shape.

Nowadays, it's impossible to run a business without its online presence. The online presence (buying & selling) of a business is called ecommerce. It's far easier to start an online business rather than an offline one. You need to build a website or app and then integrate it with an ecommerce merchant account to accept online payments. By doing this, you will be able to generate revenue from the very first day.

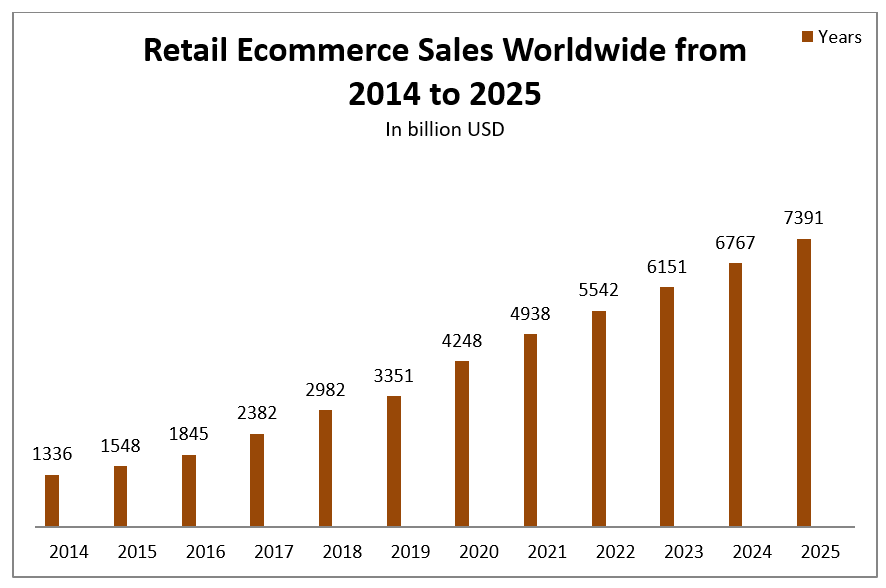

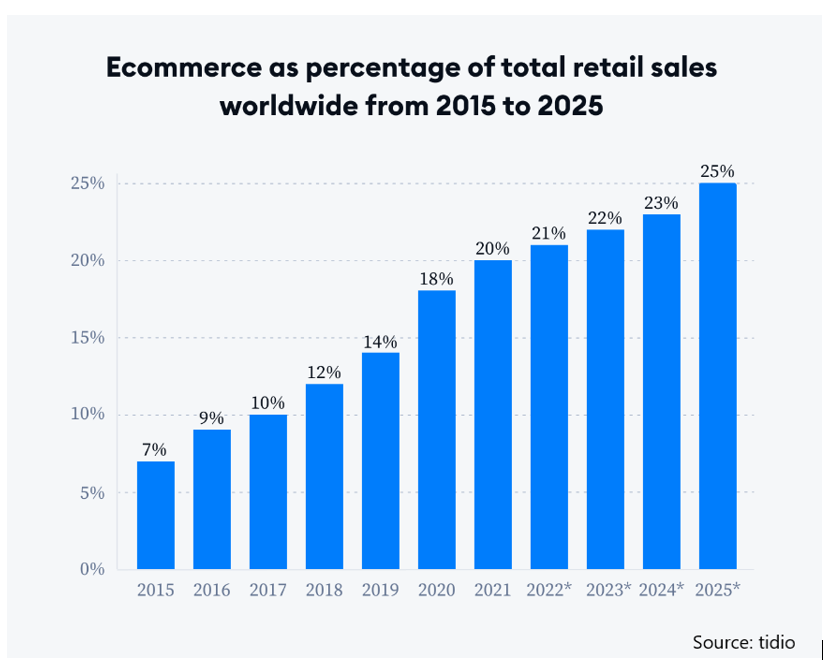

What does a businessperson want when he starts a business? Of course, revenue and continued growth. The ecommerce market is the only choice at this time due to its global expansion and growth. It started from the bottom and now reached almost 17% of the total world trade in B2B, and in the retail sector, ecommerce crossed $5.5 trillion, amounted to 21% of total retail sales, and will rise to $7.4 trillion by 2025.

27% of the world's population shops online, meaning 2.4 billion shoppers exist globally. In the US only, more than 230 million online shoppers exist, meaning nearly 70% of the US population shop online. The covid-19 outbreak played a significant role in the rise of the ecommerce market as the street market was closed due to the virus explosion and lockdown. Previously, the ecommerce sector was restricted to only developed countries, but the pandemic brought it to developing and underdeveloped countries.

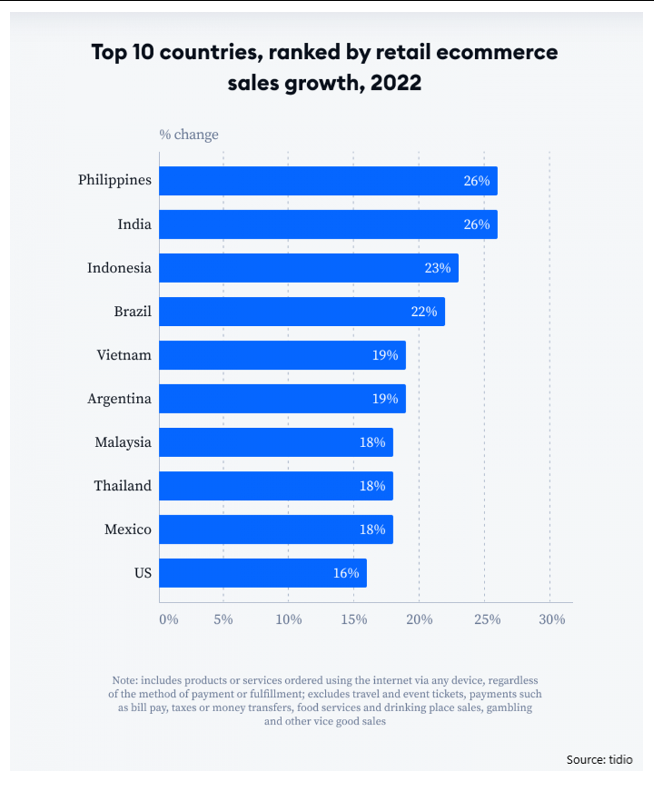

The rise of the internet and online marketplaces make it easy for people to shift digitally. The world witnessed 27.60% growth in the ecommerce market in 2020, whereas the most flourished region was Latin America, with a rise of 36.70%. Similarly, North America 29.10%, Asia-Pacific 26.40%, Western Europe 26.30% and Middle East & Africa 19.80% noticed the respective growth rate. This can be seen in the below illustrations:

6 out of 10 countries that witnessed the highest growth rate in the ecommerce market in 2022 are from Asia. Whereas Brazil, Argentina, Mexico and US are from the west that notices the highest growth rate in 2022.

It's a traumatic truth that your ecommerce business is considered high-risk by banks and financial institutions, and they do not provide you with financial solutions for it. But you do not need to worry because many PSPs are there to offer you payment solutions like an ecommerce merchant account, high-risk merchant account, international payment gateway, ecommerce payment gateway, online business merchant account, etc. If there are several PSPs, how do you choose the best one? Simple, here we are mentioning some of the features a PSP must have:

Multiple Payment Modes: A payment service provider must give as many payment options as possible to increase the merchant's income because an ecommerce firm has a global reach, and every nation has its own preferred payment method. A consumer may switch to another app if your app doesn't offer his chosen payment method. A PSP must provide credit card processing, online banking, digital wallets, and BNPL because these are some of the most popular e-commerce options and will help retain customers.

Acceptance of Multiple Currencies: As we told earlier, the global ecommerce market is vast and cross-border sales are the highest-growing section of the ecommerce market. To conduct international business, you must accept the global currency. So a PSP must receive payment in almost every currency of the world. Taking local currency increase loyalty towards the company and revenue.

Security & Anti-Fraud Tools: Friendly chargeback is one of the most significant drawbacks of the ecommerce market. People falsely claim a refund for goods and services you provide. So a PSP must have 3-tier chargeback prevention tools to eradicate each false claim. A PSP must employ AI and ML to differentiate between a genuine customer and a fake one. Furthermore, An ecommerce merchant has a high chance of fraud, so a PSP must have PCI-DSS compliance, CVV Checker, fraud scoring and 3D secure authentication to safeguard you.

Customization- A payment gateway needs to be simple to integrate and flexible enough to meet the needs of a merchant. For its merchant web or app, the high-risk ecommerce merchant account provider should be able to offer a tailored payment platform.

Customer Support: For an ecommerce business, 24/7 customer service is essential as people around the world shop according to their local time. Customer service should offer quick & simple solutions to any problem a merchant may have in both regional and foreign languages.

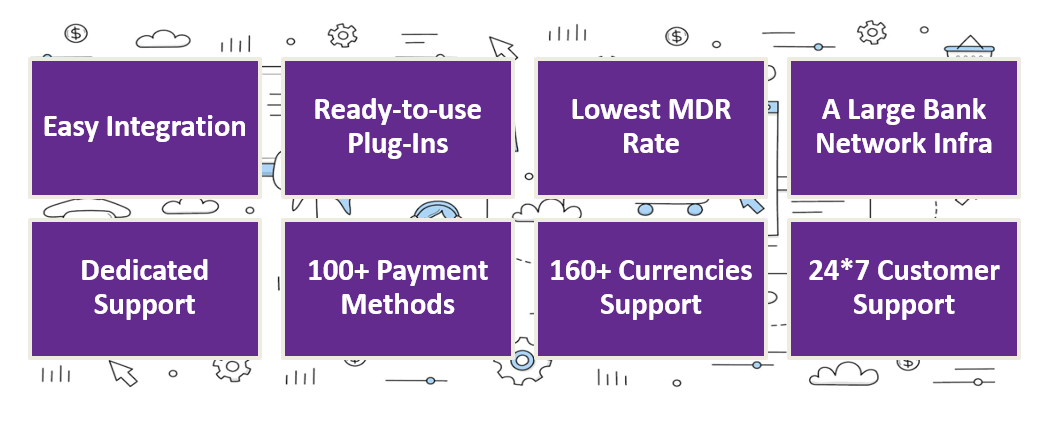

We are the best payment solution provider for an e-commerce merchant account for a number of reasons. We provide you with the cheapest MDR rate, the safest payment surroundings, and the fastest payment processing. We have worked along with major card issuers like Visa, MasterCard, JCB, and others. To protect you from fraud, we adhere to PCI-DSS level-1 (the highest level of certification) and use AI, ML, and other cutting-edge technology. Hundreds of features have also been developed by us for your benefit. We also have the following features:

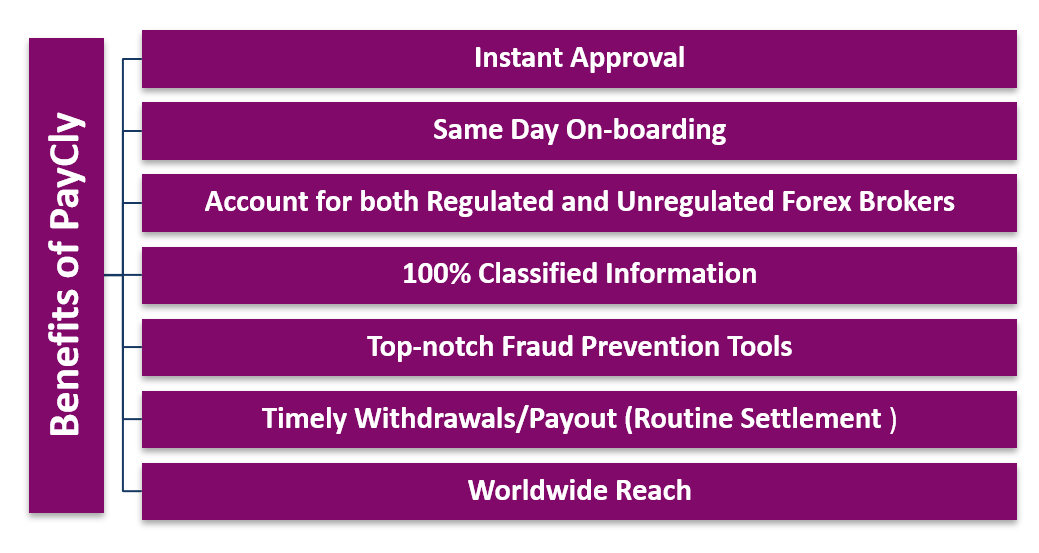

If features don't benefit you, there is no point in offering them. Our custom-made e-commerce merchant account is a prototype. Every feature we provide is intended to benefit you in some way. The first thing to note is that our e-commerce merchant account is a special account with characteristics of both high-risk and international merchant accounts. These are some additional advantages that come with choosing PAYCLY as your business partner.

The scale of the e-commerce market is constantly expanding rapidly. This trend is likely to continue in the upcoming years as businesses discover that maintaining an online store is less expensive and simpler than maintaining an offline store. Additionally, there are more platforms and technologies available to aid small firms in beginning their e-commerce operations. PAYCLY is the best ecommerce payment gateway provider for payment solutions; choose us and let us help you grow. Please visit us at PAYCLY.com for further details.

These accounts' principal objective was to protect high-risk companies from chargebacks and fraud. Sector-specific merchant accounts are high-risk accounts with features unique to the industry (such as casinos, forex, sex toys, dating, escort, etc.). According to comments from our merchant, these accounts have reportedly become the top choice for all the merchants they recommend.

You may get all the payment options you need for your online business from PAYCLY. To help you expand your business internationally, we have put together several cutting-edge merchant accounts that combine high-risk merchant accounts with international payment gateways.

| Forex Merchant Account | Casino Merchant Account |

| Online Dating Merchant Account | Fantasy Gaming Merchant Account |

| Escort Merchant Account | Adult Toys Merchant Account |

| Gambling Merchant Account | E-Cigarettes Merchant Account |

| Offshore Merchant Account | SMM Panel Merchant Account |

We are everywhere. In Australia, South America, North America, Europe, Asia, and Africa, we provide a variety of payment solutions. In nations like Canada, the US, the UK, Mexico, Brazil, New Zealand, Japan, Australia, Germany, France, Spain, Italy, Nigeria, Turkey, etc., we are a rising star. No other PSP in Southeast Asia can compete with us. We are the best provider of payment services in Singapore, Thailand, the Philippines, Indonesia, and all other countries, and we offer the best high-risk merchant accounts, global payment gateways, FX merchant accounts, and other payment solutions.