According to Researchandmarkets, the global gambling market crossed $747.9 billion in 2022 and is anticipated to grow steadily. With the increasing internet penetration, the online gambling market has captured one-third share of the global gambling market in a short time.

Almost everything is going through a digital revolution. So, we can see this trend in gambling too. The spike in online gambling is because it enables people to gamble or bet on various games and lotteries online from anywhere. It provides a customer better access and a fair chance to win the prize rather than offline gambling. Nowadays, games are being created wildly to gamble online, which is a paragon of growth in online gambling.

In a report by national gambling statistics, in the USA, 85% of people have gambled at least once in their life. The online gambling industry is a new sensation for Millennials, Gen Z and Gen Y, whereas Gen X still prefer offline gambling. Most of the world's population belongs to the first three categories, so the online gambling market is yet to grow more and more.

We just see how lucrative and potential the gambling market has. If a business person wants to enter this huge market, he needs to have an Online Gambling Merchant Account to accept online payments.

A gambling merchant account is similar to a regular bank account as it allows you to take, hold and withdraw funds that you received from gamblers. Due to the high-risk nature of the gambling business, banks and financial institutions do not provide a high-risk gambling merchant account. The gambling industry is considered a high-risk industry due to several factors, including chargebacks, fraud, return volume, nature of the business, erratic demand, legal ambiguity, and business structure. Still, you do not need to worry because several PSPs can furnish you with a merchant account, but choose one that has specialisation in your sector, like PAYCLY.

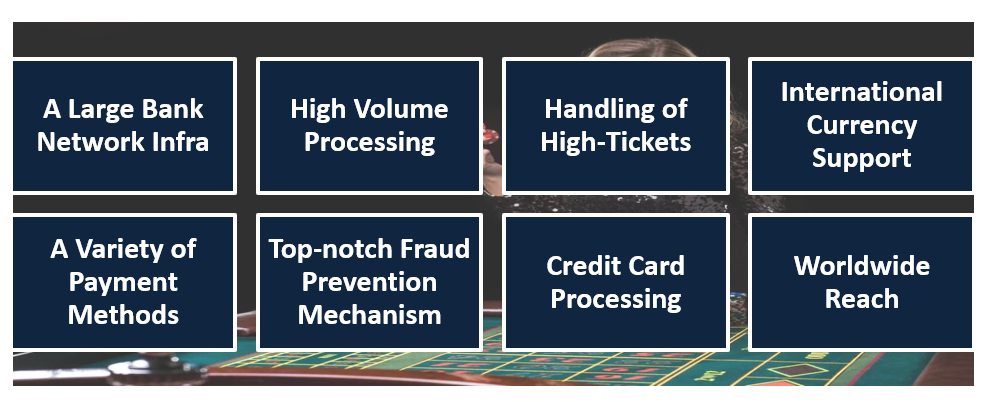

Gambling merchant needs a specialised merchant account with both high-risk and industry-specific features. An online gambling merchant account functions similarly to a standard high-risk merchant account with payment acceptance options like cryptocurrency, e-wallets, and card not present transactions from credit cards. Additionally, it enables a business to accept payments in various methods and currencies.

You will require a gambling merchant account if you plan to launch an online gambling business or want to expand it. You won't be able to take payments using credit cards or other standard online payment methods without a merchant account. The merchant account also safeguards you from payment fraud and chargeback. It provides top-notch security for every transaction made on your website or app. Additionally, e-invoicing, real-time tracking and detailed transaction history are a few more features a merchant account has.

Online gambling includes every online game or betting that provides you with the chance of prize-winning. We've mentioned a few here:

|

Online Casino Online Poker Online Bingo Online Lottery Live Betting on Every Sport iGaming |

Fantasy Games Sports Betting eSports Live Table Games Horse Racing Betting Mobile Gambling |

These are the well-known games we have mentioned here, but nowadays, new games are evolving, especially for gambling, that will definitely help merchants grow their business.

There are numerous reasons Banks, Financial Institutions and Payment Service Providers (PSPs) consider a gambling merchant account as a high-risk merchant account. Here we've mentioned below some of the main factors:

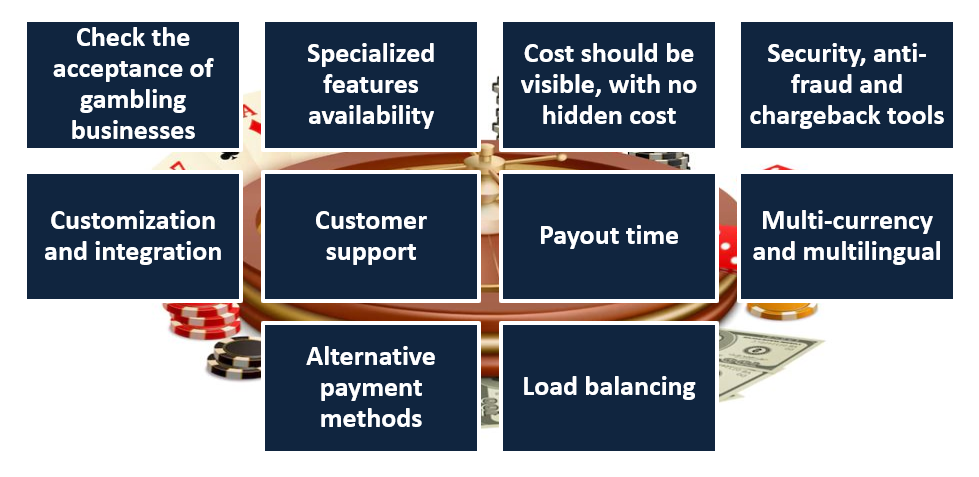

There are several essential features that a high-risk merchant account provider must provide, but we have to choose a PSP that provides both the features of a high-risk as well as a gambling merchant account. We've mentioned a few:

Check the acceptance of gambling businesses: High-risk payment gateway providers do not accept all high-risk businesses. To confirm that it supports your business type, visit the website of your high-risk payment gateway or speak with its sales representatives. If you are an unregulated gambling merchant, then make sure your PSP supports unregulated accounts or not.

Specialised features availability: Enquire that the PSP you are choosing facilitate some specialised feature related to your gambling, betting or gaming industry.

Cost should be visible, with no hidden cost: A high-risk merchant account may have slightly higher fees than a low-risk one. Every PSP may have a different payment module, but make sure all costs are disclosed. On the provider's website, you should be able to find the monthly fee for a high-risk account. If not, a quick phone call or talk should put your worries to rest.

Security, anti-fraud and chargeback tools: A gambling merchant account usually provides its services to the whole world. A gambling or casino merchant account must comply with PCI-DSS level 1 (highest level), CVV and AVS Checker, fraud scoring and 3D secure authentication. Fraud is more likely to occur on high-risk accounts. A merchant account provider with cutting-edge technologies to stop chargebacks and other fraud should be sought out.

Customization and integration: A payment gateway which is provided with a merchant account to accept the payment must be easily integrated and customized according to a merchant's requirements. The high-risk merchant account provider should be able to provide a customized payment platform for its merchant web, app & mobile.

Customer support: 24*7 customer support should facilitate by PSP to gambling or Gaming Merchant Account holders, as online betting can be done at any time at any place. Customer support should be available in regional as well as international languages that provide quick & easy solutions to any issue a merchant may face.

Payout time: The top merchant account provider provides timely payouts. Check the payout windows before integrating. The typical payout can be weekly or bimonthly and varies from business to business.

Multi-currency and multilingual: A gambling merchant must ensure that its PSP accepts multiple currencies and supports numerous languages. You should be prepared to take a variety of currencies with no trouble because customers from different countries use different currencies and languages.

Alternative payment methods: It's a necessity for gambling, betting, or gaming merchants to accept payments in as many methods as possible. A merchant account provider must accept payment via credit or debit cards, cryptocurrencies, e-wallets, bank transfers, etc., as every nation has its own payment preferences.

Load balancing: By using load balancing, you can split up your transactions among different merchant accounts linked to a single PSP. In this way, even if one account fails, you will always have the others to rely on.

These are the features a merchant account provider must facilitate its merchant. If any PSP has more added features, you can compare it with the best one before finalising.

The online gambling, betting, or gaming market is on a boom. Almost every person on earth wants to try his luck to get a sudden large amount to fulfil his dreams. This is a psychological inclination of a person towards gambling which makes him play. Due to the industry in growing business persons are looking to take advantage of it. A merchant account is the first necessity to enable a gambling merchant to accept payments. We've discussed several aspects of gambling merchant accounts in the article. A gambling high-risk merchant account provider must provide the discussed essential features to its merchant. If you are confused about choosing the best one, we will lessen your burden by providing you with the best gambling merchant account in the market because of our services. PAYCLY is the single solution for your business. PAYCLY offers every mentioned feature as well as others that are not mentioned here. PAYCLY also offers payment gateway solutions for unregulated merchants as we believe that equal opportunity of business is the right of everyone.

Basically, these accounts are designed for high-risk businesses to secure them from excessive fraud and chargebacks. The industry-specific merchant account means accounts with features of the industry (casino, forex, sex toys, dating, escort, etc.) and a high-risk merchant account. Feedback from our merchant told us that these accounts had become the first choice for all the merchants they refer to.

Proudly stating we, PAYCLY, are here as a payment service provider that has each & every solution for your online business. We have assembled some state-of-the-art merchant accounts with a blend of high-risk merchant accounts & international payment gateway so that you can grow your business globally.

| Forex Merchant Account | Gambling Merchant Account |

| E-Commerce Merchant Account | Fantasy Gaming Merchant Account |

| Escort Merchant Account | Adult Toys Merchant Account |

| Dating Merchant Account | E-Cigarettes Merchant Account |

| Offshore Merchant Account | SMM Panel Merchant Account |

Table Of Content