The modern world has been running over some digital pieces of information known as data, and to reach this information, the internet is required. Nowadays, the internet has revolutionized the functioning of human activities, and one such activity is trade. Trade or business has been a prominent factor in helping us reach this distance in the race of evolution. But now it has become totally different from what it was before the age of the internet. The modern business landscape has totally embraced the online operating system. Due to the clientele’s growing love for online payments because of the conveniences in payment making. As a result, businesses need some kind of online infrastructure to receive payments, and to fulfill this requirement, merchant accounts are introduced. On the basis of businesses, a merchant account is labeled as a low-risk or high-risk merchant account.

Low-risk ones are comparatively easy to get due to the lesser risk involved in online payment processing. On the other hand, high-risk ones are equally difficult to get, as these accounts have to go through tough scrutiny before approval by banks. Because businesses they serve pose several difficulties in payment processing, like a high chargeback ratio, vulnerabilities to online fraud, and complex regulatory scenarios. However, acquiring a merchant account for high-risk business is not that tough if you have knowledge about it.

In this blog post, we will go through the high-risk merchant accounts so that you can get a better understanding of these business tools. Also, we will highlight here how you can get a merchant account for high-risk business in Singapore. So, stay tuned to polish your high-risk payment processing skills to thrive your high-risk business in the highly competitive market of Singapore.

But before that, let’s understand the businesses that require these accounts.

High-risk businesses are those that operate in industries with elevated legal, regulatory, or financial challenges, like a higher risk of fraud and chargebacks. Examples of high-risk businesses include online gambling, forex trading, adult entertainment, subscription-based services, etc.

These businesses face hurdles such as complex and evolving legal frameworks, stringent regulations, and potentially volatile market conditions. For businesses in this category, obtaining essential services like online payment processing can be challenging. But a high-risk payment gateway and an online high-risk merchant account do the trick for them. Both of these tools help high-risk businesses get access to online payment processing services. Some renowned high-risk industries are:

| Online Casinos and Gambling | Forex Trading |

| E-Commerce | Fantasy Gaming |

| IPTV Services | Adult Toys and Entertainment Industry |

| Dating Apps and Websites | Subscription-based Services |

| Tobacco and Tobacco Related Products | Social Media and Digital Marketing |

A high-risk account is a specialized banking solution for businesses operating in industries deemed high-risk due to legal, financial, or regulatory complexities. These accounts come with tailored risk management and rigorous underwriting processes to mitigate the elevated risks associated with such businesses. High-risk accounts also provide businesses with the tools and support needed to navigate the unique challenges of their industry while ensuring compliance with relevant regulations. And one such prominent tool is a high-risk gateway that links a business website or app to a merchant account and enables payment transactions by transferring the payment details. Because high-risk accounts come with a high processing fee, if you need a cheap high-risk merchant account in Singapore, stay tuned.

Selecting a merchant account for high-risk businesses requires careful consideration and research. Here are key steps to help you make an informed choice:

Understand your specific business requirements, transaction volume, and industry. This will help you narrow down the options and choose a provider that aligns with your needs.

Look for reputable, high-risk merchant account service providers with a track record of serving businesses in your industry. Seek referrals from industry peers and read reviews.

Compare the pricing structures, including transaction fees, processing rates, and any additional costs. Look for transparency in fee structures.

Inquire about the underwriting process and the documentation required. A thorough underwriting process can indicate a provider's commitment to risk management.

Ask about the security and fraud prevention measures offered. Look for providers with strong encryption, chargeback prevention, and risk mitigation tools.

Verify that the provider has expertise in navigating the regulatory requirements specific to your industry.

Inquire about any additional services or features offered, such as various payment methods, multi-lingual and international payment processing, or multi-currency support.

By thoroughly evaluating these points, you can select the best high-risk merchant account provider that best suits your business's specific needs.

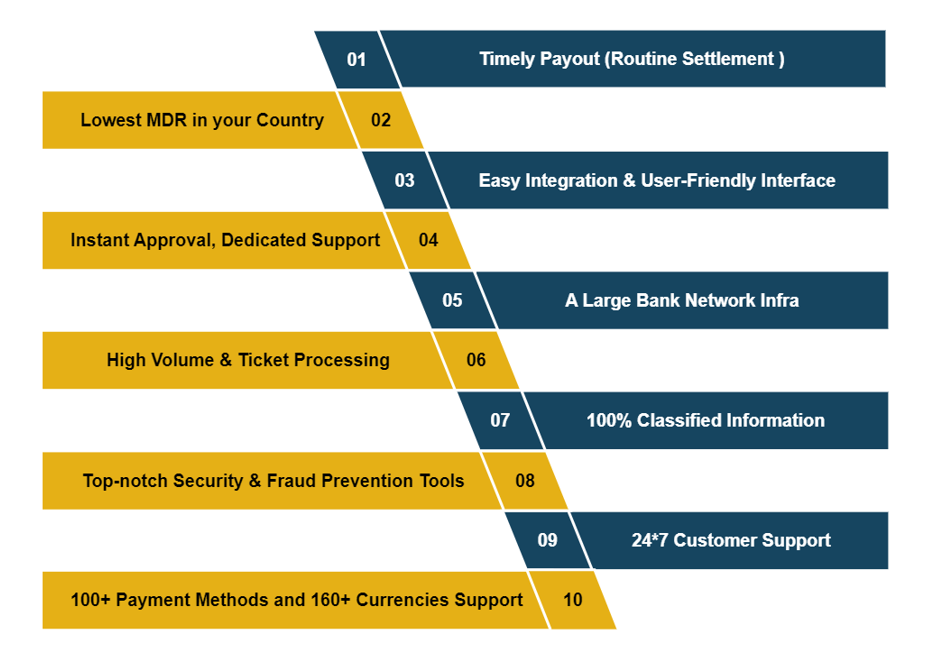

If you are looking for a top-quality but cheap high-risk merchant account in Singapore, then PAYCLY is what you are looking for. It is the single solution for all your high-risk payment-related problems in Singapore and the rest of the world, too. PAYCLY is a pioneer in online high-risk merchant account services in Singapore. All the above-mentioned qualities of a top-class high-risk account are auto-integrated with our Singapore merchant account. Furthermore, if you need anything apart from that, you can ask team PAYCLY to add services that you want, for instance, a high-risk merchant account instant approval. There are numerous reasons for you to choose PAYCLY. The major ones among them are here:

Low-Risk Merchant Accounts

High-Risk Merchant Accounts

Yes, PAYCLY assist new business owners in expanding their companies globally by offering them services like international merchant accounts, high-risk merchant accounts, international payment gateway accounts, and various online payment solutions.

PAYCLY offers a wide range of payment solutions, not just payment gateways. This includes services like credit card processing, offshore merchant accounts, and high-risk merchant accounts. We cater to both regulated and unregulated businesses, and our high-risk merchant accounts are designed to meet specific industry needs. Some of the industries we serve include online gambling and casinos, forex, e-commerce, fantasy gaming, IPTV, adult toys, and dating apps and websites, and we have extensive experience in providing payment solutions for these industries.