PAYCLY is one of the best payment gateway providers in the United Kingdom (UK). A payment gateway is a technology that facilitates payment transactions by transfer of payment details between the payment portal and acquiring bank. It authorized credit cards, e-wallet ACH and alternative payment processing for online businesses and encouraged them to expand their business.

A payment gateway is a fundamental need of an online business to accept payment, either merchant selling goods or services. Nowadays, people prefer to shop online as it allows comparison, best pricing, home delivery, and time-saving. The global ecommerce market has gained its place in world trade by acquiring 17% of its share. In 2021, the global ecommerce market reached $4.9 trillion and continuously growing to break further records.

Basically, Payment gateways are categorized into three following types; PAYCLY offers all three payment gateways to merchants:

There are hundreds of payment gateway providers in the United Kingdom, including big names Paypal, Stripe, Braintree, Checkout, Adyen, Authorize, 2Checkout, and BlueSnap, but every one of them has some cons that are widely known. These payment gateways are expensive; some do not provide plug & play to easy integration, and some do not offer alternative payment options. Similarly, some force you to sign a long-term contract, and almost all do not provide support for unregulated industries.

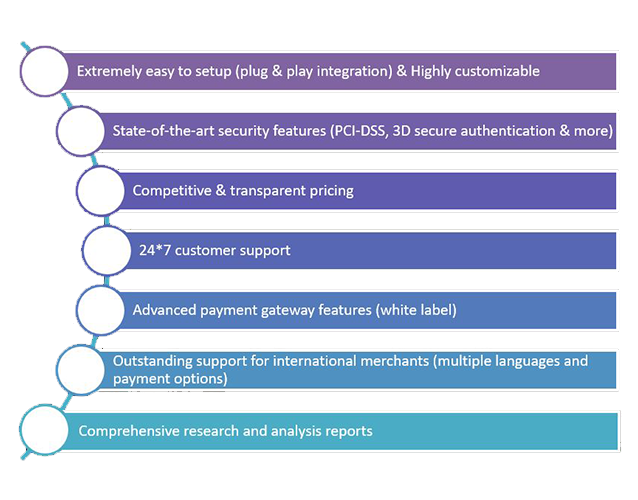

But PAYCLY is one solution you all need as it supports you in every way. PAYCLY is one of the best payment gateway providers in the United Kingdom (UK) as it treat its merchant a partner rather than a client. We have mentioned some of the advancements of PAYCLY in the below illustration:

We illustrate the process in a simplified manner to aid in understanding.

In the digital era, shoppers' behavior has changed wholly. In 2021, more than 2 billion online shoppers existed, and this number is growing continuously with the rising internet penetration. More businesses are making their presence online, and here, a high risk payment gateway is needed to accept the payment. As we discussed, hundreds of payment gateway providers exist in the UK, but PAYCLY is the best due to its services, dedicated support, and instant approval. If you are a merchant looking to obtain a international payment gateway, we suggest you must connect to PAYCLY's wizard team so that you can get the best available payment solutions in the universe.

Price is an issue that must be weighed against service quality in every business collaboration. Different gateways may have different pricing schemes. They could consist of monthly charges, flat fees for each transaction, variable fees based on the transaction's value, and extra charges for things like chargebacks, international payments, and international currency conversions.

A merchant account is similar to a bank account that retains funds from online or card payments until they are transferred to your selected business bank account. When a customer makes a payment, a payment gateway establishes a connection between your merchant account and the customer's bank, allowing the funds to transfer from the customer's bank into your merchant account (and later to your company's bank account).